Is Willscot a Zero?

Tepid demand and underperformance have weighed on WSC's stock price. We believe shareholders may have only just begun to pay the price for favoring financial engineering over operations.

It is important that investors review the Disclaimer at the end of this post.

There were none of the obligatory “great quarter, guys” preambles to analyst questions on the 2Q25 WSC conference call. It was not a good quarter or a good call. As we noted in our commentary on WSC’s 1Q25 results, the company is facing a slow moving, but perfect storm.

To wit, units on rent (UOR) continue to erode, leasing revenues are down, EBITDA down and CapEx up – a lot. WSC’s metrics look like the electrocardiogram at a certain dramatic moment in an episode of ER – they are flatlining and the patient is dying.

Poor results were more or less expected. We want to focus on the two elements in the quarter we didn’t’ expect, both of which support our thesis that WSC has an end-of-life fleet and a looming debt bomb.

Management highlighted two sub-segments of the business that are experiencing strong growth. The natural corollary is that given the overall decline in UOR, adjusting for the strong sub-segments implies that the remaining core business should be collapsing.

Additionally, WSC increased rental equipment depreciation cost substantially without explanation, despite lower leasing revenues and units on rent.

We believe the change in depreciation could well reflect a negotiation with auditors on how to write-down the value of the fleet – one painful impairment or slowly and quietly. If we are correct, could negotiations with lenders be far behind?

With every passing quarter we become more convinced that WSC cannot repay the debt with its in-place inventory. The first $1.5B is due in June 2027.

We believe shareholders may be left with an ancient fleet, a large portion of which is unrentable, and a large pile of debt. That scenario implies the equity may be worthless.

Management Inadvertently Suggests UOR in Legacy Products are Collapsing

The most telling aspect of the call was revealed in by-the-way manner as management attempted to inject some optimism into the gloomy call.

There were two bright spots in the quarter. Management noted that units on rent of climate controlled or cold storage was up 30% on a y/y basis. Rental of Clearspan structures were also up 30% on a y/y basis.

There are two problems. First, total modular and storage units on rent declined -5,386 and -17,229, respectively on a y/y basis. Two strong subsegments combined with the addition of acquired units means that the underlying performance was even worse than the bad numbers suggest. The core leasing book is likely burning-off rapidly.

Secondly, we believe WSC has few of the in-demand units. We estimate there are ~5,000-6,000 cold storage units out of 107,000 total. We do not have an estimate for newer in-demand products like Clearspan and Flex. However, we believe the vast majority of units are more traditional storage and old modular units we have shown extensively in photographs.

In order to stem the decline in revenue and cash flow, WSC must seemingly rent more climate-controlled storage and new Clearspan and flex structures. To do so, WSC must buy/build and acquire the units. The lack of inventory for in demand products is a key driver of CapEx and acquisition costs, which is essentially purchasing units within a company structure.

WSC appears to have few units customers want and many units for which there is little demand.

Management did not talk about debt this quarter, but it is there. There is a total of $3.6B. The $1.5B ABL is due in June 2027. We think it is unlikely that the ABL lenders extend and we do not think WSC can repay either the 2027 or longer-dated debt with its in-place inventory. There may be a reckoning.

Depreciation Charge Up, Chief Accountant Out

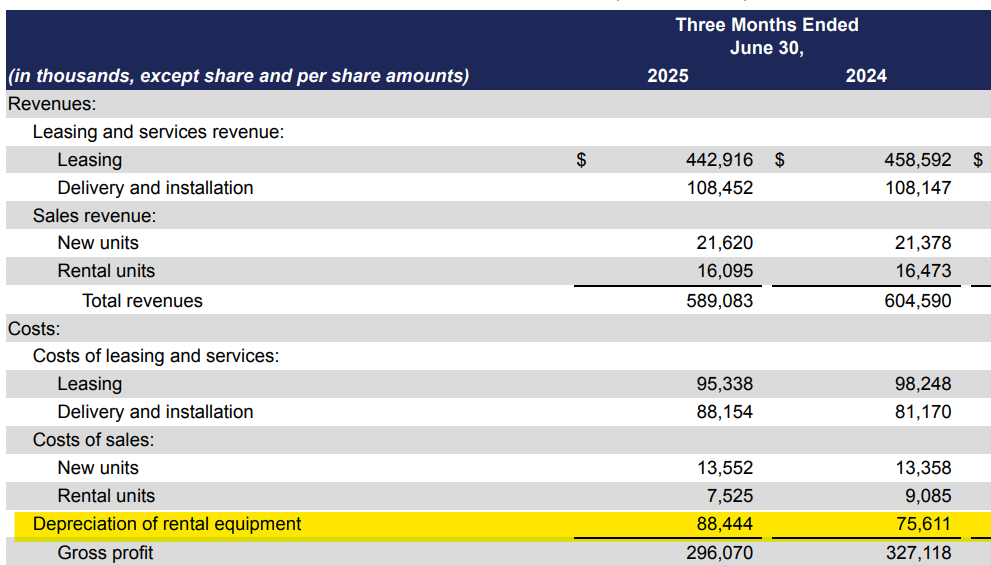

The 2Q25 10-Q records a substantial increase in depreciation. We show it in the exhibit below.

Depreciation Charge Up Sharply

Source: WSC 2Q25 10-Q.

The exhibit shows a 17% increase on a y/y basis despite leasing revenue declining -3.4% over the period and, as discussed earlier, lower units on rent. Depreciation increased to 20% of leasing revenues in 2Q25 from 16% in 2Q24. The change seems to large to be an adjustment. Rather, it appears to be a policy change implemented in 2Q25.

The intra-year change in depreciation looks like an accounting fire-drill, in our view. We will have to wait for the 10-K for an explanation, because we did not see one in the 10-Q.

We interpret the timing and lack of disclosure around the change in depreciation as the likely outcome of negotiations with the auditor on how to redice asset values - fast or slow. The change implemented is not a dramatic, one-time footnote inducing impairment charge, but an increase in depreciation to take down the value of the fleet over time. It is gentle, optically more acceptable to investors, and apparently can be done without an explanation in the quarterly filing.

If we are correct regarding negotiations with the auditor on asset values, how far behind could the banks and ABL lenders be?

Coincident with the change in accounting is the departure of WSC’s Chief Accounting Officer. As this 8-K notes, Sally Shanks, an 8-year WSC veteran and key accountant is leaving. Our assumption is that the change in depreciation and the departure of the CAO are related.

There is other supporting evidence as well. A recent debt report from Fitch discussing what they believe to be “appropriately managed residual risk” and “strong asset quality”. In our view, this suggests the analyst is playing defense.

We believe the change in depreciation and the tone of the debt note suggest that service providers and lenders have seen our work questioning WSC’s asset values and debt repayment capacity and are taking it seriously.

We could be wrong, but in our view, the mosaic indicates that the trouble we see with debt and assets is being recognized and acknowledged by other stakeholders.

Conclusion: Slow Implosion

Every quarter seems to bring another element supporting our thesis that WSC is not a financially viable entity. The quarterly results in 2Q25 were only modestly worse than expected. The surprise was the implication that UOR is worse than it appears. The change in depreciation accompanied by the departure of an accounting director is suggestive of ase value issues, in our view.

The true nature of WSC is slowly being revealed. We view WSC as less an equipment rental company than a financial construct using debt to buy growth and repurchase stock. We believe it is a business model with a limited lifespan.

We suspect that in the end, shareholders may be left with an ancient, largely unrentable fleet, and $3.6B in debt. In that scenario, we believe the equity could be worthless.

DISCLAIMER

This report represents the opinions of Keith Dalrymple and Dalrymple Finance on Willscot Mobile Mini. It is an opinion piece and should not be taken as investment advice of any kind. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Willscot Mobile Mini’s webpage provides sell-side firms and analysts that provide research coverage. The firms and analysts listed are in the business of providing investment advice to individual and institutional investors. We strongly encourage those seeking investment advice to consult one or more of the sell-side research firms listed.

The report is based on publicly available information and due diligence Dalrymple Finance believes to be accurate and reliable. However, it is presented “as is” without warranty of any kind, whether express or implied. Dalrymple Finance makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report contains a large measure of analysis and opinion. It is subject to change without notice.

Following the publication of this report we intend on continuing to transact in the securities mentioned. We may be long, short or have no position at any time. That position may change at any time.

We are investors with the goal of profiting from our research. You should assume that as of the publication date, that Dalrymple Finance, Keith Dalrymple and/or affiliates have a position in the securities mentioned in this report. We have a vested financial interest in securities discussed in this report.

In no event shall Dalrymple Finance or Keith Dalrymple be liable for any claims, losses costs or damages of any kind, including direct, indirect and otherwise, arising out of or in any way connected with information in this report.

So this is mostly about the assumption that those decrepit units (that you do not quantify in nominal or % numbers) are needed for their debt funding ? To me it just looks like its cheaper to let them rot than to recycle them and theyre gonna be close to 0 on the balance sheet. https://x.com/bmb21/status/1979184060434911317/photo/1 the ABL is extended, the interest coverage isnt amazing but why on earth is this a 0 ? 250M Interest expense | 590M OCF | 250M CAPEX | 680M EBITDA