WSC: It's About Renting Equipment

WSC needs to increase units on rent, but reversing the negative trend is difficult. Tim Boswell was vague on the timing of inflection; our analysis suggests it is not going to happen anytime soon.

It is important that investors review the Disclaimer at the end of this post.

On the 1Q25 conference call, management spoke bullishly of growth levers and investment in the fleet. Meanwhile, utilization continues to plummet and the long-established trend of declining growth has shifted into outright shrinkage. It was like a conference call out of the Twilight Zone with the narrative pointing in one direction, and actual financial performance in another. Let’s inject some reality into the discourse.

WSC rents equipment. They key to the financial model is renting more. Units on rent (UOR) need to inflect higher to change the negative operational and financial trajectory. President Tim Boswell answered a question on UOR inflection on the call in what we found clearly unconvincing and non-committal language. Perhaps he had good reason. Our analysis suggests UOR are unlikely to inflect higher his year. More likely, in our view, UOR will continue to grind lower, pressuring the financial model.

Narratives of growth and “returning capital” via buybacks may placate shareholders short-term, but they do not change financial reality. Eventually investors will have to look to the future and ask how their highly levered equipment rental company with utilization rates below 60% and falling can survive.

The Long Slope Down

Utilization is the elephant in the room no one asked about on the call.

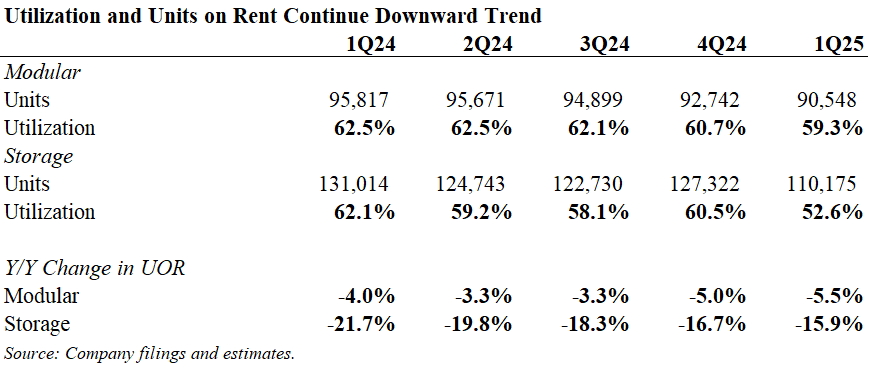

Utilization in modular slipped below 60% with -5.5% decline in UOR on a y/y basis. Storage came in at 52.6%, with a -15.9% decline on a y/y basis. In our view, these metrics are deeply problematic and indicative of a failing business. Both are shown in the table below.

WSC’s dismal performance comes as United Rentals (URI) talks up its success, noting it is expanding in both storage and modular. We interpret this to mean that it is odds-on probability that URI is gaining and/or working to gain market share versus WSC in the large project segment. Note that URI’s original focus was only on storage, but now includes modular as well.

Management stated that it remained “poised to invest in our fleet, which will drive higher net CapEx versus last year”. Given UOR are shrinking, this is exactly when the “optional CapEx” part of the bull thesis should kick in, but it isn’t. In our view, this is further confirmation of belief that a key part of WSC’s business model has been extracting cash that should have been reinvested in the fleet. Were the fleet well-maintained, we believe WSC would have the room to age it during periods of weaker demand, reducing CapEx.

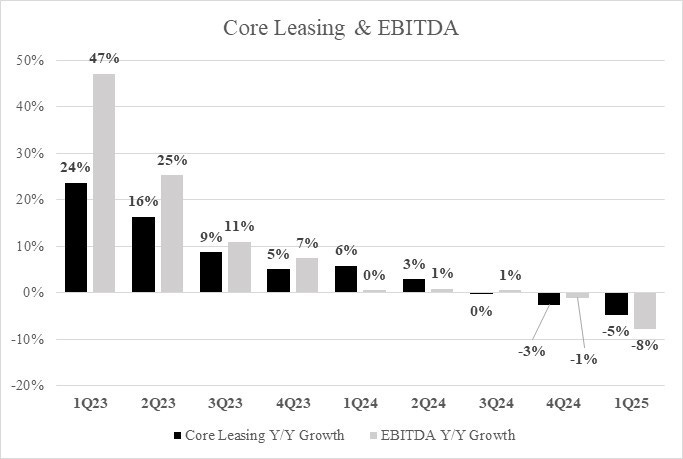

Declining UOR was initially masked by increased pricing and VAPS attachment. No more. WSC’s growth model has been thrown into reverse, as evidenced in the chart below.

If performance was this poor during a period of solid economic growth, we can’t help but wonder how WSC will far in a less certain economic landscape with mounting competition?

Units on Rent Will Likely Continue to Grind Lower

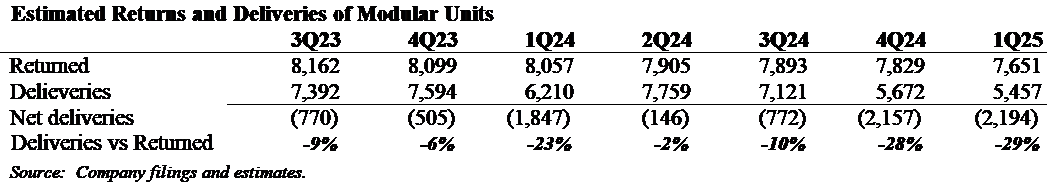

The most interesting question asked on the conference call was regarding UOR and when the downward trend may change. In response, Mr. Boswell noted that given an average 3-year lease duration, you need several quarters of sustained y/y delivery growth to cause unit on rent portfolio to inflect”.

As to when UOR would inflect higher, Mr. Boswell continued “by the end of the year you’re kind of maybe getting closer to flattish, right?” Mr. Boswell’s language is profoundly lacking in conviction, in our view. Some back of the envelope analysis might show why.

In the table below we assume that 8.25% of modular units on rent in the preceding period are returned in the current quarter, which equates to 33% annual lease expiry. We then take the absolute change in UOR reported in the quarter and back-out deliveries.

Our model is admittedly basic and ignores seasonality, but over time it should give us some perspective on the dynamics of deliveries versus expiring leases referenced by Mr. Boswell.

Quarterly returns should decline going forward reflecting lower units on rent. Theoretically, there should eventually be a crossover when deliveries exceed returns. However, predicting when that might occur is difficult, as it appears that deliveries are declining at a faster rate, increasing the net negative delivery gap. If accurate, this implies that the long-awaited point where UOR inflect higher is not approaching, but has gotten more distant.

We believe our model reflects the current business dynamics where WSC is the high-cost provider in an environment with demand headwinds and increasing competition. A retired industry executive once told us that negative utilization trends are hard to fix. That is evident here.

If we assume that quarterly returns decline to 7,150 for the next three quarters, WSC will have 21,450 returns for the remainder of the year. If we assume deliveries in the remainder of the year match the average of 6,851 from 2024, there will be 20,552 deliveries for a deficit of 898 units. That would equate to a year-end utilization rate of approximately 58.7% with 4Q25 UOR 3,092 below 4Q24.

If our model approximates the reality of WSC’s fleet dynamics, modular UOR are highly unlikely to inflect higher in 2025. As for flattish - it depends on your definition.

It’s a Slow Moving, but Perfect Storm

So, pricing power has faded. VAPS revenues have flatlined. WSC typically rents at premium prices. Fleet is becoming more widely available industry-wide. Competition from a larger, better funded company is increasing. And now, our analysis shows that modular UOR are likely to continue to decline throughout the year. Not much, if anything, is going right, in our view.

Despite the clearly negative dynamics, management maintained (admittedly lackluster) guidance and continues to entice shareholders with stock repurchases and dividends. Management spent roughly $50M repurchasing 1.84M shares at an average price of approximately $27/share. We suspect that these repurchases, like all the other repurchases that came before, will end up being cash mis-spent on high-priced stock.

Buybacks may provide some temporary support for the stock and satisfy short-term shareholder demands, but eventually financial realities will win the day.

DISCLAIMER

This report represents the opinions of Keith Dalrymple and Dalrymple Finance on Willscot Mobile Mini. It is an opinion piece and should not be taken as investment advice of any kind. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Willscot Mobile Mini’s webpage provides sell-side firms and analysts that provide research coverage. The firms and analysts listed are in the business of providing investment advice to individual and institutional investors. We strongly encourage those seeking investment advice to consult one or more of the sell-side research firms listed.

The report is based on publicly available information and due diligence Dalrymple Finance believes to be accurate and reliable. However, it is presented “as is” without warranty of any kind, whether express or implied. Dalrymple Finance makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report contains a large measure of analysis and opinion. It is subject to change without notice.

Following the publication of this report we intend on continuing to transact in the securities mentioned. We may be long, short or have no position at any time. That position may change at any time.

We are investors with the goal of profiting from our research. You should assume that as of the publication date, that Dalrymple Finance, Keith Dalrymple and/or affiliates have a position in the securities mentioned in this report. We have a vested financial interest in securities discussed in this report.

In no event shall Dalrymple Finance or Keith Dalrymple be liable for any claims, losses costs or damages of any kind, including direct, indirect and otherwise, arising out of or in any way connected with information in this report.