WSC's Upside-down Financial Model

Revenue and EBITDA are pressured, CapEx increasing, free cash flow declining and debt maturities coming. Will Willscot Mobile Mini survive?

Please read the extensive disclaimer at the end of this report and before the appendix with additional photos.

It wasn’t supposed to be this way. Had the McGrath transaction closed, financial results would have been better, perhaps guidance would have held, WSC wouldn’t have had to increase debt to pay the $180M break-up fee, and there would have been more to look forward to than eroding fundamentals and more promises of stock buybacks.

The Willscot Mobile Mini bull thesis was that the company generated higher than industry norms free cash flow through management acumen, scale, which conveyed pricing power, and innovation with value added products and services (VAPS) provided a long runway of revenue growth.

We believe a large part of the company’s apparent financial success was the result of financial engineering: an acquisition driven model that facilitated chronic underinvestment in fleet assets.

We believe management’s implicit bet was that they could under-invest/ age the fleet without consequences, because constant acquisitions at scale would refresh the fleet enough to provide rental equipment for new sales and access to more debt.

The strategy worked until recently. Ageing the fleet and increasing debt created the illusion of excess cash flow, which was then diverted to stock repurchases, in our opinion.

When the FTC’s blocked the McGrath acquisition, it signaled the beginning of the end. We think 3Q24 results show that the company’s financial model has been upended and the business model is unwinding:

· Long ignored utilization problems in focus – Modular utilization is depressed at 62.1%, storage has plummeted to 58.1% or 1,310 basis points from 71.2% at the end of 2023. Storage is down 3,080 basis points from 88.9% at the end of 2022. Fixing the serious utilization issues will require lower prices, higher CapEx, and will be a long, difficult task in our view.

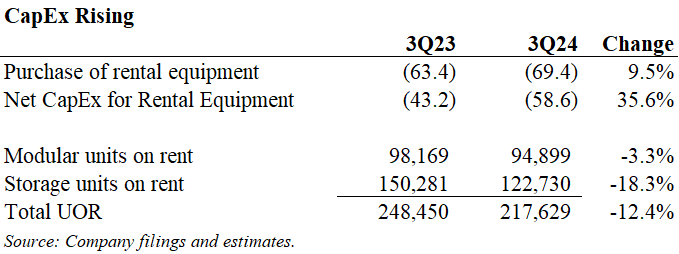

· Key pillar of bull thesis falls - company spending debunks the “optional CapEx” part of the bull thesis. Rental equipment spend rose ~10% on a y/y basis despite total units on rent declining -12%. We believe that CapEx is increasing so much because the 57,000 idle units implied by WSC’s 62.1% modular utilization rate do not exist, in practical terms. In our view, C,apEx will likely remain elevated due to the old, decrepit fleet we exposed in earlier work.

· Upside-down financial model – WSC’s Goldilocks model of EBITDA and free cash flow growth driven by strong pricing, low CapEx, and debt funded acquisitions is gone. It has inverted to no EBITDA growth, high CapEx, and eroding free cash flow. Net CapEx in the quarter was +35% y/y, while activations of modular were -7%; implications are that CapEx per activation +40%.

· Competition heats up as the market cools down – United Rentals’ commentary indicates the company would like to own modular and storage in large projects. URI is threatening to take the demand-rich large-project segment, leaving the weaker, smaller construction segment to WSC.

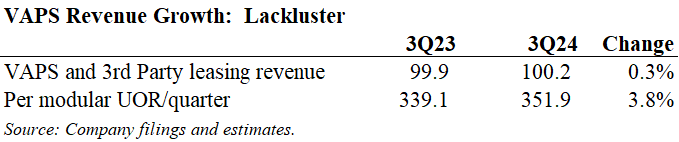

· The shrinking VAPS opportunity – Management has framed VAPS as a $386M opportunity. Actual aggregate VAPS growth is ~1% and adjusted for declining units on rent, it is up only 3.8% per unit, suggesting the revenue opportunity is significantly smaller than management would like investors to believe.

· Will WSC Make it? There are ~$2B of maturities between now and June 2027. Management says they can opportunistically refinance at least some of it. If WCS’s financial model breaks-down further, will lenders continue to support one of the most highly levered companies in the industry, and if so, at what price? The modular industry has a history of asset-mismanagement/debt induced failures. Don’t say it can’t happen here.

Long-ignored: utilization matters

In the strong economic environment of 2020 to 2023, falling utilization did not appear to be a serious issue. Pricing at the unit level and the growth of VAPs revenue drove revenue and EBITDA growth. We believe that period was an anomaly. The equipment rental business has always been and remains one of capacity utilization. Pressured financial results means investors can no longer ignore utilization.

In 2Q24, analysts asked several questions on the timing of when units on rent would inflect higher. Such questions were notably absent from the 3Q24 call. Perhaps it was due to the continued slide of utilization or the general lack of optimism. As shown below, investors will have to wait longer for that inflection.

Utilization rates below 70% are typically viewed as troubling in the industry. Both segments are far below that. Although the rate of decline at modular has moderated, storage has been a wreck for the last two years. This is important for two reasons, in our view. Storage, although smaller from a revenue perspective, is a higher margin business. Further, United Rental’s storage business, though we don’t have granular detail, is doing well, suggesting the negative storage dynamics, noted by McGrath and particularly acute for WSC may stem, in part, from increasing competition.

Declining pricing power means that growth must come from increased utilization. Increasing utilization will be a long and difficult task, in our view. We believe that to do so, WSC will likely have to reduce pricing and increase spending to remain competitive with local and regional operators with higher quality fleets.

Increasing utilization may also be challenging due to recent shifts in the competitive landscape. We believe United Rentals (URI) is aiming squarely at certain WSC markets. URI management was queried about the business on the 3Q24 call. CEO Matthew Flannery responded thusly:

United Rental: They Might Be Giants

Source: URI 3Q24 call transcript.

Mr. Flannery later said that URI didn’t necessarily want to be the biggest in the business, but the biggest with their customers. We interpret these remarks as a direct shot across WSC’s bow. It seems URI will work to become the largest modular and storage provider in their business or with large projects.

Large project demand has been relatively robust in contrast to the weaker smaller, construction segment. We would consider it a seismic shift in the competitive landscape and a substantial reduction WSC’s revenue opportunity if URI moves aggressively to build market share in large projects.

Consequences of chronic underinvestment: units on rent down, CapEx Up

CapEx in the context of utilization is a key indicator, in our view, and it shows CapEx is not optional after all. Here we are with moderating demand, yet CapEx is increasing, as shown below.

In 3Q24, rental equipment spend rose ~10% on a y/y basis while total units on rent declined ~-12% in total.

According to the bull thesis, declining units on rent means that management should be able to optionally downshift on CapEx spending. Had the acquisition of McGrath been consummated, lowering CapEx may have been an option. With large acquisitions off the table due to FTC intervention, WSC must make due with its ~20-year old modular fleet.

WSC’s rising CapEx contrasts sharply with McGrath’s flexibility. On the 3Q24 conference call, after discussing lower y/y utilization, MGRC management said: “We responded to the softer market demand conditions by reducing new equipment capital spending and carefully managing operating costs.”

We believe that WSC management does not reduce CapEx because they can’t.

Where Are All Those Idle Units?

We believe company CapEx patterns support our thesis that the modular fleet, which is where most spending goes, is at the end of its life. With current utilization of 62.1%, 37.9% of the fleet should be on the sidelines in some state of readiness to rent. The 37.9% vacancy rate implies that WSC has 57,917 idle modular units.

Why increase CapEx so much if there are 57K idle units? We believe WSC may technically have 57K idle units, but our lot surveys suggests that a large portion of them are too old and decrepit to be rented. The old units may work as loan collateral, but require a substantial and expensive overhaul to be rentable. Thus, from a practical perspective, we believe a large part of the 57K idle modular units don’t really exist.

We believe WSC resurrects old units by stripping and remanufacturing. We provide photographic evidence in the Appendix that shows what appears to be the process stripping and rebuilding of modular units on numerous WSC lots.

The aha moment: WSC’s business model has been turned upside-down

Management’s assertion that CapEx is optional is sometimes true – only not for WSC. Optionality stems from previous investment in fleet maintenance. Well-managed companies maintain a younger fleet, in part, so that they can age it during a downturn. URI’s management addressed this exact issue on their 2Q24 conference call.

URI: Fleet Age and Cashflows

Source: URI 2Q24 conference call transcript.

URI management elects not to maximize cashflows during cyclical highs in order to generate more cash during downturns when financing tends to become more difficult and expensive, and shareholder scrutiny rises.

Since coming public, we believe WSC’s financial model was based on chronic under investment and ageing of the fleet, which flatters near-term cash flows. Fleet renewal was largely accomplished with acquisitions, including periodic large transactions.

The implicit bet was that the company could underinvest in maintenance and new equipment, because it could acquire needed units. It worked for many years, but the jig is up.

We believe that without large acquisitions to provide younger equipment, management has been forced to adopt a counter-cyclical investment model where CapEx must be increased during a time of financial pressure. The result is mounting financial pressures, a lack of financial flexibility and the destruction of free cash flow.

At the beginning of 2024, management was guiding for 10% EBITDA growth for the year. After lowering guidance twice and firing staff (restructuring) during the year, management is guiding for a flat year on the EBITDA line.

Viewing EBITDA guidance in the context of critical expenses shows a new base-line financial model, as shown below.

2024 guidance compared with 2023 actual results suggest that WSC’s business model is upside down.

We believe, 2023 results with higher units on rent and lower CapEx were supported by earlier strategically timed acquisitions, perhaps anticipation of equipment from McGrath, pricing tailwinds, VAPS growth. Changes in pricing and VAPS growth, and especially the surprise denial of the McGrath transaction in 2024 have upended the financial dynamics.

In 2024, CapEx must increase 43% in order to maintain flat EBITDA. Assuming the company incurs no new debt, the implication is free cash flow erosion of ~-12%.

We believe attempts to grow the top-line will make near-term financial dynamics worse: CapEx, will likely need to rise further to support units on rent growth, and pricing will likely need to come down to be competitive. To illustrate why this is the case, consider net CapEx in the context of unit activations:

WSC’s presentation notes that activations in both segments were down y/y. Despite that, CapEx increased 35%. The implication of the lower activations/higher spend is that CapEx per unit deployed is unit activated is increased approximately 40%.

The math suggests that growing units on rent will require CapEx to increase at an higher than current rate.

The upside-down financial model puts management in a difficult position. The status quo is stagnation and eventual EBITDA decline. Though EBITDA margins may be maintained, free cash flow margins decline.

Attempts to grow units on rent would likely require lower pricing and significantly higher CapEx. Aggregate EBITDA could rise, though margins would compress and free cash flow would take an outsized hit.

After years of gaming the system, it seems the system is now gaming WSC.

Is the VAPS Opportunity is Overstated?

The growth opportunity from VAPS is central pillar of the bull thesis. We believe, it too, is broken. The exhibit below was taken from the company’s 3Q24 earnings presentation.

The VAPS Opportunity

Source: Company presentation

Management portrays VAPS as a $386M annual revenue opportunity across modular and storage. Modular is the largest at $330M. In our previous report (here), we provided analysis suggesting that the growth in VAPS was largely over. The 3Q24 numbers support that thesis, as shown below.

On an aggregate basis, VAPS revenue increased less than 1% on a y/y basis, adjusting for the decline in units on rent, the figure is a little better at 3.8%. In our view, the unfavorable dynamics of lower units on rent and slowing price growth, makes $386M VAPS revenue opportunity look more a pipe-dream than a reasonable, expected outcome.

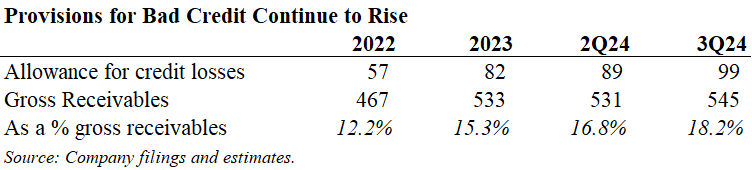

Silent But Deadly: Rising Provisions for Credit Losses

WSC’s provisions for credit losses are becoming more troubling. Quite honestly, after we made the topic widely known with previous report, we thought the sell-side would ask management about it on the 3Q24 call. It didn’t happen. Nor did management address the issue voluntarily.

The table below shows the latest.

Allowances for credit losses increased to 18.2% of gross receivables. The rate is almost 15x McGrath’s allowances in 3Q24 of 1.3% of gross receivables.

In the quarter, gross receivables increased $14M. 73% of the increase, or $10M, was allocated to expected credit losses.

Perhaps there is a perfectly reasonable and acceptable explanation for what are by industry standards massive provisions, but management’s silence on the issue is not encouraging. Given the vacuum of disclosure, we are inclined to believe provisions provide cover for a material accounting issue.

This is a critical issue in need of illumination. Perhaps investors should petition the company’s auditor, Earnst & Young LLP, to require WSC to provide a detailed analysis of the root cause of the provisions.

Will WSC Survive?

Our analysis of 3Q24 results shows that WSC’s financial model has been upended. The negative dynamics are defined by pressure on the revenue and EBITDA lines and erosion of free cash flow. The financial model shift is occurring as competition is increasing and maturities of WSC’s substantial debt stack come into view.

The company has $525M due in June 2025 and another $1.5B due in June 2027.

Management is behaving as if nothing has changed and appear to be keenly focused on the stock, enticing investors with promises more stock repurchases.

We believe that everything has changed for the company and the old playbook is no longer valid. Management has stated that they have the ability to “opportunistically” refinance debt. Perhaps. But how long with lenders accommodate one of the most levered companies in the industry, now a broken roll-up with eroding fundamentals?

The history of the modular office rental industry is littered with bankruptcies stemming from mismanagement of assets. Perhaps we are at the stage where the old is new again.

DISCLAIMER

This report represents the opinions of Keith Dalrymple and Dalrymple Finance on Willscot Mobile Mini. It is an opinion piece and should not be taken as investment advice of any kind. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Willscot Mobile Mini’s webpage provides sell-side firms and analysts that provide research coverage. The firms and analysts listed are in the business of providing investment advice to individual and institutional investors. We strongly encourage those seeking investment advice to consult one or more of the sell-side research firms listed.

The report is based on publicly available information and due diligence Dalrymple Finance believes to be accurate and reliable. However, it is presented “as is” without warranty of any kind, whether express or implied. Dalrymple Finance makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report contains a large measure of analysis and opinion. It is subject to change without notice.

Following the publication of this report we intend on continuing to transact in the securities mentioned. We may be long, short or have no position at any time. That position may change at any time.

We are investors with the goal of profiting from our research. You should assume that as of the publication date, that Dalrymple Finance, Keith Dalrymple and/or affiliates have a position in the securities mentioned in this report. We and affiliates have a vested financial interest in securities discussed in this report.

In no event shall Dalrymple Finance or Keith Dalrymple be liable for any claims, losses costs or damages of any kind, including direct, indirect and otherwise, arising out of or in any way connected with information in this report.

APPENDIX

We think that part of WSC’s strategy is to retain old units, strip them for parts and rebuild in lieu of purchasing new units. We believe the following photographs are evidence of the strategy. All photographs were taken in June 2024.

Modular units in Syracuse New York.

What appear to be modular unit rebuilds in Kansas City, MO

More of what appears to be reconstruction in Chicago, IL.